You can re-finance your loan; you may either pose a question to your bank to lessen the interest rate or balance transfer to a different sort of lender

This new Reserve Lender from Asia (RBI) announced this would keep the repo rates, the interest rate at which banking companies obtain regarding main financial, intact following its about three-day Financial Rules Committee (MPC) appointment ended for the Thursday. Positives state it’s time to comment your house mortgage cost so if you’re spending a dramatically higher superior along the repo rate, you might imagine refinancing-where you transfer the existing financial to a different bank giving less price.

Brand new poor seems to be more than. Rates is stabilising. Rising prices helping, i . If you are on the a repo-linked mortgage, the rate will be instantly reset after any repo speed alter in this 25 %. A reduced rates offered at home loan sector now have the variety of 8.408.fifty percent to have eligible individuals. While you are paying a somewhat higher rate, think an effective refinance. Whenever you shave out-of fifty base activities or higher from your own rate, it could produce tall offers over the longterm. After you think about your home loan speed, along with consider it with regards to the premium you only pay along the repo. Instance, at 8.50 %, this new superior across the repo is actually dos %.

Just like the , new RBI enjoys raised the repo rate half dozen times, causing an entire improve out-of 250 basis what to 6.fifty per cent. Since stop gurus individuals, it is still vital that you find a way to do mortgage interest rates.

Large rates of interest result in increased equated monthly instalments (EMIs) if you wish to continue current cost agenda. For instance, toward a home loan from Rs fifty lakh having a good 15-year tenure from the eight per cent, the new changed EMI could be Rs 52,211, compared with the old EMI from Rs 44,941-a rise from Rs eight,270. Extending the mortgage tenure is one way for current consumers so you’re able to handle rising rates. Yet not, this 1 gets the downside away from highest interest costs. On the given example, extending the latest tenure by 7.5 years due to a two.50 % interest rate raise would produce paying an extra Rs 40 lakh into the desire over the lengthened period. Once the financing tenures have more than doubled, banking institutions turned so you’re able to increasing EMIs due to the fact a standard scale.

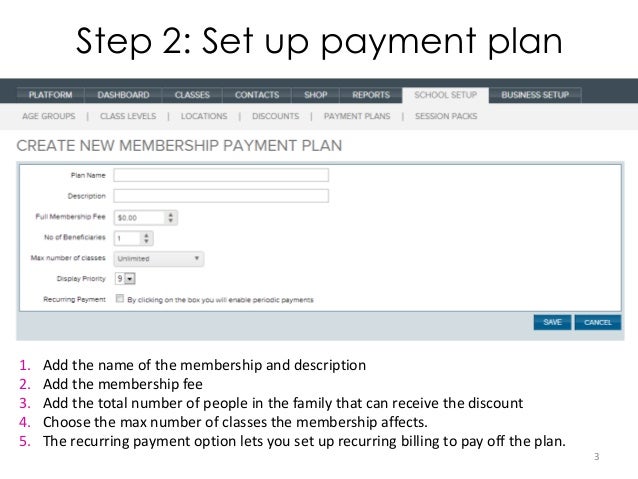

Re-finance along with your latest lender: Request a diminished rate of interest from the present financial. That one is relatively cheaper, requires restricted records, and will trigger attention offers.

Primary individuals that have a good credit score records and you will strong earnings history can be borrow at the low advanced while others will have to pay large, Adhil Shetty, Ceo, BankBazaar

Refinance which have a new financial: Thought an equilibrium transfer to a different financial. Although this option get involve running and judge charge, it can cause less notice will set you back. Lakes West online loans However, it entails papers.

Opt for a high EMI: Voluntarily desire spend a high EMI. This method doesn’t incur any additional will cost you, therefore allows the mortgage to be paid back shorter. This new disadvantage was a higher month-to-month outflow.

Prepay: If you have a lump sum number, you could apply new prepayment studio to repay the loan before brand new scheduled period. Like, a loan out of Rs 20 lakh with an interest rate out-of nine % having two decades contributes to a whole payable level of Rs lakh having an enthusiastic EMI regarding Rs 17,995. If the debtor decides to prepay the borrowed funds entirely after a decade, the quantity getting repaid would-be Rs lakh, leading to an interest protecting out-of Rs seven.38 lakh. But not, prior to making a prepayment, think about the tax positives youre currently choosing towards lenders.

Whilst the RBI have chose to keep up with the repo speed within six.5 percent, they remains prepared to work when your situation calls for they. Considering the likelihood of rising interest levels later on, it is advisable to save well on home loan attention costs.