How much money that you need to spend could be dependent upon your discretionary money. Normally, your repayments might be comparable to fifteen% of one’s discretionary earnings.

The price of rehabilitating your own education loan was not any longer than just sixteen% of the unpaid principal as well as the level of appeal you features accumulated. Definitely, how much money you will have to pay straight back monthly could be highly dependent on your money and also the quantity of your loan that you still need to pay-off. It is common for a few people to pay only $5 30 days, as you must be repaying more than just that it.

What are the benefits to rehabilitation?

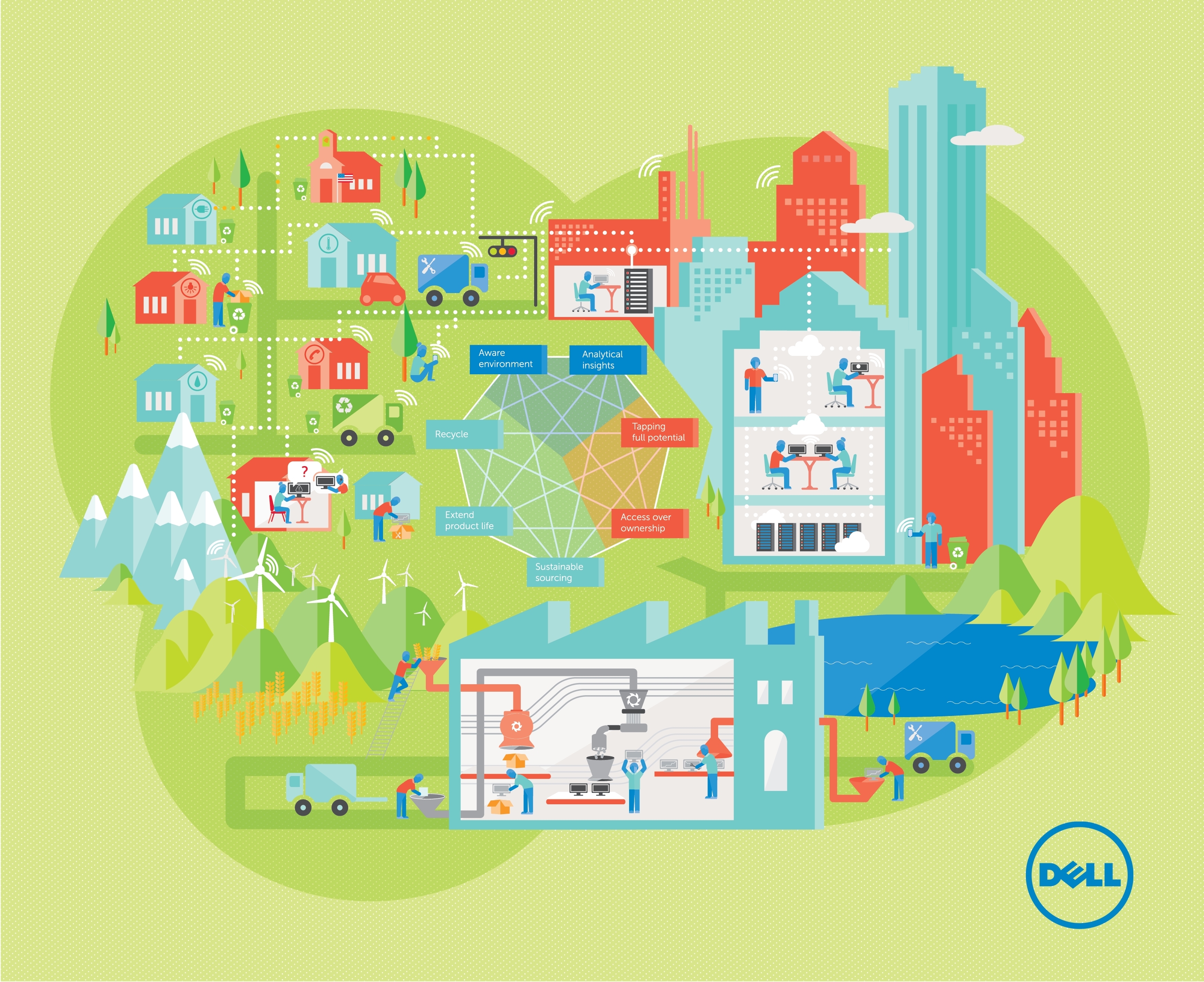

Ahead of i dive for the benefits of treatment, glance at the chart lower than. It explains a comparison from exactly how much we offer your mortgage repayment to settle relation to your credit score.

Needless to say, this is a good ‘guideline’ image. But not, it goes to display your that perhaps the minuscule push in the your credit score normally substantially enhance your mortgage payment. Hence, if you have good blip in your credit history, following this is an issue that will have to become corrected.

The major advantage of going right through education loan treatment would be the fact you are going to be capable remove one default position.

It is worth noting that if you perform default toward a great mortgage, then you are not will be in a position to get school funding once more  . The reason being you are going to currently have already been deemed getting ‘untrustworthy’. Needless to say, this isn’t top if you are in the midst of studying. Of the defaulting in your financing, you could totally eradicate any promise of pursuing the profession road that you like.

. The reason being you are going to currently have already been deemed getting ‘untrustworthy’. Needless to say, this isn’t top if you are in the midst of studying. Of the defaulting in your financing, you could totally eradicate any promise of pursuing the profession road that you like.

(NOTE: Is actually their student education loans providing you a standard nightmare? Prevent standard and you will understand how to turn good “Default” position toward a “Current” standing within just 3 months that with our very own Street Map so you can Delivering Figuratively speaking Regarding Default. Click on this link for more information and now have the latest totally free chart – in advance of your next fee date!)

Although not, when that default is removed through the procedure of rehab, you will then be able to re-apply getting scholar help in the future.

Fundamentally, if you don’t get rid of the default standing, you might never be able to sign up for deferment or forbearance later. Consequently there will be fewer available options to you personally if you find an occasion your location struggling to create money on your mortgage.

Naturally, this will make it even more complicated to help keep your borrowing rating in balance. A lot of people who default on the mortgage regularly might not additionally be capable rent a home as his or her get is so reasonable. Needless to say, that isn’t something you are likely to need to has actually taken place!

Are there drawbacks in order to treatment?

However, it is value mentioning there may also be a great few drawbacks to that particular program. You are going to need to believe men and women cons one which just determine whether here is the right one for you.

Very first, if you aren’t likely to be able to make people 9 costs monthly, in that case your account is about to remain in standard.

While we already mentioned, the latest costs really should not be excessive. Might are different according to your discretionary earnings. Yet not, the discretionary earnings won’t account fully for one costs that you will have making your bank account. Because of this you might not currently have the bucks called for in order to satisfy your loan costs.