Contents

Looking to see this one play out over a 7 day time frame. A doji is a trading session where a security’s open and close prices are virtually equal. A bull is an investor who invests in a security expecting the price will rise. Discover what bullish investors look for in stocks and other assets. Technical traders using this indicator should place a stop buy order slightly above the upper trendline of the handle part of the pattern.

If I didn’t use any type of stop, the gain averaged 113% with losses averaging 33%. Before I continue, when I refer to a cup in this article, I’m referring to a cup with handle chart pattern. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

IBD Digital Presidents Day Sale

When trading inverted cup and handle pattern, traders set the stop loss above the handle. Round bottom with a small retracement What you would want to see on a classic cup and handle is a nice round bottom with followed by a slight retracement. Volume breakout After the formation of the cnh, the market will try to make a run, temporarily breaking the horizontal resistance. As with all technical analysis setups, the Cup and Handle pattern has some limitations. The pattern typically takes 1-6 months to form, but it can also happen quite quickly or take much longer, making it ambiguous in some cases. You need a stop-loss order to get you out of the trade if after buying the breakout, the price drops, instead of rising.

- It starts when a stock’s price runs up at least 30% … This uptrend must happen before the cup base’s construction.

- In fact, the confirmation of this pattern comes when the stock price passes above the resistance level and starts moving upward.

- Remember, patterns won’t look perfect all the time, and it’s unrealistic to expect them to do so.

- Basing refers to a consolidation in the price of a security, usually after a downtrend, before it begins its bullish phase.

- This breakout was followed by a significant decrease in the price of the currency pair.

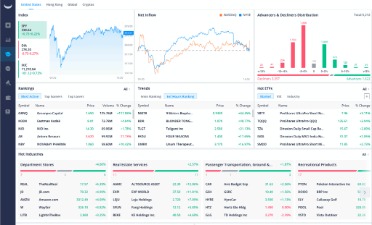

In addition to the price levels, some traders also look at trade volume in the asset before entering a trade after a cup and handle pattern. Higher volume indicated that more investors are buying that asset, and higher demand could lead to higher prices in the near future. The cup and handle chart patterns triggers a signal when it breaks out of the handle. The target with the cup and handle pattern is the height of the cup added to the breakout point of the handle. Generally, these patterns are bullish signals extending an uptrend. Another issue has to do with the depth of the cup part of the formation.

Trading Cup with Handle: Stops

I compared the https://en.forexbrokerslist.site/ price to the value of the moving average. However, I didn’t find any cups with the breakout price below the 50-day SMA, so I don’t show any results. A bullish chart pattern appears and you buy at the breakout. Continue holding until your selected chart pattern appears. The chart pattern is bullish because it has an upward breakout but then things go wrong.

The price will likely continue in that direction though conservative traders may look for additional confirmation. A common stop level is just outside the handle on the opposite side of the breakout. The Inverted Cup and Handle is the bearish version that can form after a downtrend. TradingView has a smart drawing tool that allows users to visually identify this pattern on a chart. A cup and handle is a technical analysis pattern that appears on a chart as a U-shaped pattern, followed by a small downward drift, resembling a handle. As with most chart patterns, it is more important to capture the essence of the pattern than the particulars.

Trading the bullish Cup and Handle pattern

At this point, the cup and handle chart pattern will be evident. That can maximize the likelihood of predicting a breakout while potentially minimizing risk. If the cup and handle form after a downtrend, it could signal a reversal of the trend. To improve the odds of the pattern resulting in an actual reversal, look for the downside price waves to get smaller heading into the cup and handle.

The handle will typically form a descending trendline … Take a look at the chart below for an example. The best place to enter a trade using this pattern is when the handle forms. Remember what I said earlier about O’Neill — the man who made the cup and handle pattern famous? Even he admitted that this pattern isn’t an exact science. It’s important to note that even O’Neil says the pattern isn’t an exact science. Sometimes the initial drop from the top of the cup can go as deep as 75% … And sometimes the cups don’t even have a handle.

However, the following analysis does give a real-world flavor for how well you might do trading chart patterns if you follow the pattern pair strategy. To identify the cup and handle pattern, start by following the price movements on a chart. The pattern starts to form when there is a sharp downward price movement over a short time. This is followed by a period where the price remains relatively stable.

How is cup and handle formed?

The longer and rounder the bottom/top, the stronger the signal. A V-shaped bottom/top is not usually considered a good Cup and Handle pattern. Trades work best if the breakout price is above the 200-day moving average. Keep in mind that sample counts were few (if you consider 130 as being “few”).

Trading Cup and Handles With MarketSmith Pattern Recognition

For example, https://forex-trend.net/ a cup with an upward breakout in a bull market and selling a busted broadening bottom shows winning trades making an average of 168%. The annualized gain is 14%, giving the setup a rank of 41 . If you traded this without a stop, the net gain climbed to 90%. Of the stocks I looked at, I found 69 trades with 43% of them winning. Expectancy was $9.62 per share, ranking 15th where 1 is best.

Netflix formed a six-week-long flat base beginning in June 2017. The streaming pioneer flew out of that chart pattern the next month, but quickly pulled back to form a cup with handle. Note how the bottom of that new base formed right around the buy point in the prior pattern — a positive sign of support.

Both the https://topforexnews.org/ and Handle pattern and the inverse type tell a similar story about the market but from different perspectives . So, we will discuss the Cup and Handle pattern; the opposite applies to the inverse pattern. Selling the first busted pattern which appears does best.

We’ve mentioned it several times, but our guide tobacktestingand how tobuild a trading strategy are excellent resources that will help combat this issue. When you are trading the inverse Cup and Handle pattern, you should place your stop loss order above the highest point of the handle. While some patterns may have a well-rounded bottom/top, like a bowl/dome, others just make a slight turn at the bottom/top, as the case the makes.

Also, remember smart trading requires more than just knowing a pattern. I’ve given you hints in this post about how to trade the cup and handle pattern. But if I gave you only “buy here, sell here” I’d be doing you a great disservice. On the chart above, I’ve drawn three arcs to represent cups. And it’s a good example of a cup and handle pattern failure. The bounce out of the handle was very small before continuing downward.

You have a sell signal when the price breaks below the lower trend line of the price channel that forms the handle. There should be a spike in volume when this breakdown happens. You may go short at the close of the breakdown candlestick, or you place a stop sell order slightly below that lower trend line. It might be wise to wait for a break below the support line established by the lows of the inverted cup. With this pattern, a buy signal occurs when the price breaks out of the upper trend line of the price channel that forms the handle.